Hi guys,

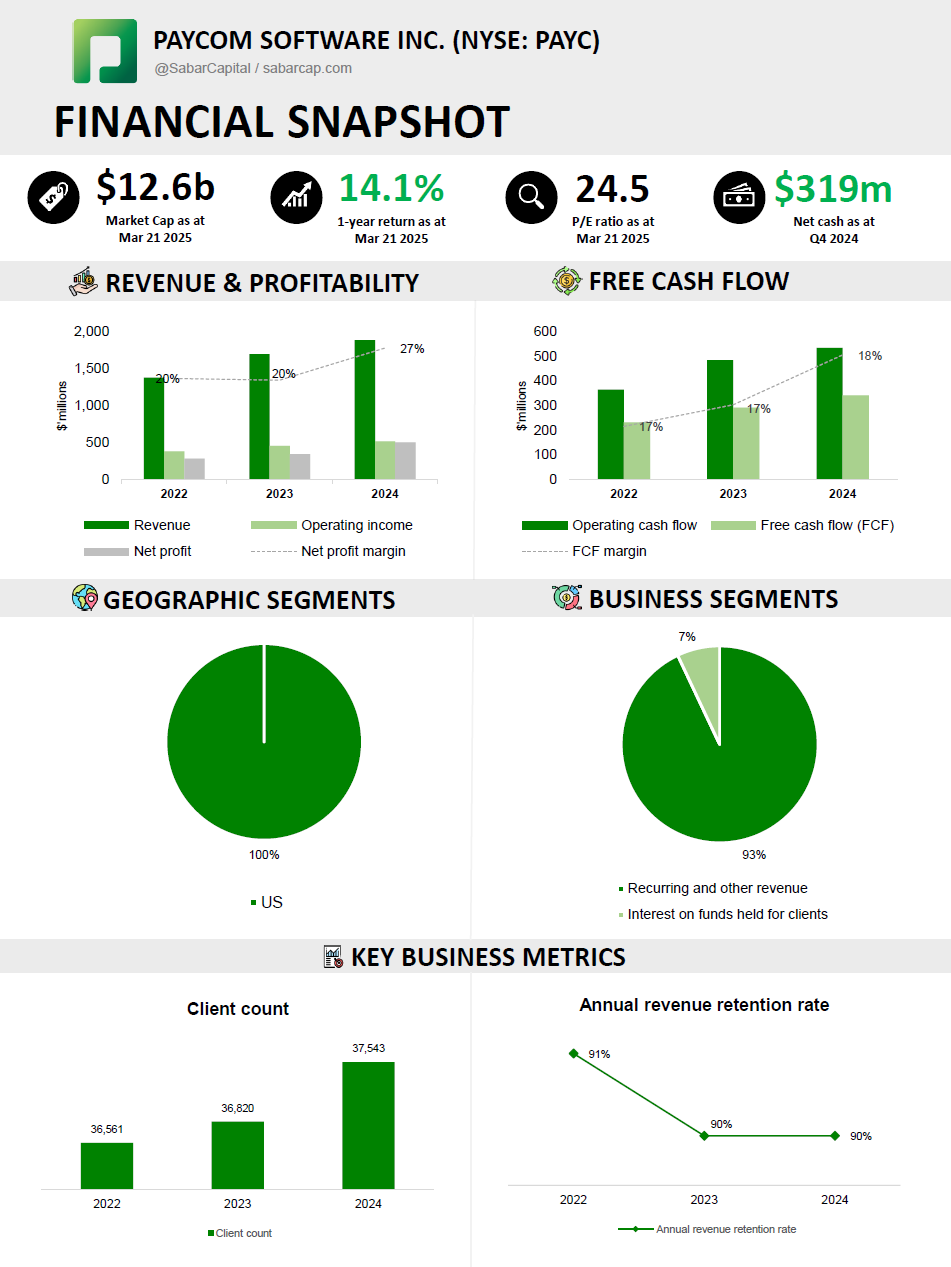

This week’s company is on Paycom Software Inc (NYSE: PAYC), a ~$12b market cap human capital management SaaS company that’s focused on automating solutions for the small to mid-sized companies in the US.

This founder-led company caught my attention last year when it faced what appeared to be self-inflicted revenue headwinds after introducing its BETI product. BETI helps customers reduce payroll expenses by minimizing filing errors — which, in turn, reduced Paycom’s revenue. At first glance, this seemed counterintuitive, but it struck me as a smart long-term move. By prioritizing customer outcomes over short-term gains, Paycom is strengthening its alignment with clients and reinforcing the durability of its business. Enjoy!

My idea of the Company Snapshot series is to offer a quick dive into a business, highlighting what makes them special. Rather than a lengthy deep dive, this format focuses on a high level overview, providing readers with digestible insights. Each Company Snapshot will follow this structure:

Business Overview

Competitive Landscape

Key Financials

Opportunities

Risks

Business Overview

Founded in 1998, Paycom Software Inc provides cloud-based human capital management (HCM) solution delivered as a Software as a Service (SaaS) for small to mid-sized companies in the US. Paycom offers functionality and data analytics that businesses need to manage the employment life cycle from recruitment to retirement.

Paycom’s software is based on a core system of record maintained in a single database for all HCM functions, including payroll, talent acquisition, talent management and HR management and time and labor management applications. Paycom’s software requires no customization and is user-friendly for easy adoption by employees, enabling self-management of their HCM activities in the cloud, reducing administrative burden on employers and increasing employee productivity.

Their software was developed in-house and is based on a single platform so there’s no need for clients to integrate, update or access multiple databases, which are common issues with competitor offerings that use multiple third-party systems in order to link together their HCM offerings.

Paycom’s revenue can be categorized into recurring and other revenues (~93%) and interest on funds held for client (~7%):

Recurring revenue: Derived primarily from payroll, talent acquisition, talent management, HR management and time and labor management applications, fees charged for tax form filings and delivery of client payroll checks and reports, and revenues associated with background checks and income and employment verification services.

Other revenues: Implementation fees for the deployment of their solution and revenues from sales of time clocks as part of our time and attendance services. Non-refundable implementation fees are charged to new clients at contract inception. These fees generally range from 10% to 30% of the annualized value of the transaction.

Interest on funds held for clients: Paycom earns interest income on funds held for clients. Funds held for clients are amounts collected from clients in advance of either the applicable due date for payroll tax submissions or the applicable disbursement date for employee payment services. These collections from clients are typically disbursed from one to 30 days after receipt, with some funds being held for up to 120 days. We typically invest funds held for clients in money market funds, demand deposit accounts, certificates of deposit, commercial paper and U.S. treasury securities until they are paid to the applicable tax or regulatory agencies or to client employees.

Paycom’s revenue is generated from fixed amounts charged per billing period plus a fee per employee or transaction processed; and fixed amounts charged per billing period. The billing period varies by client based on when each client pays its employees, which could be weekly, bi-weekly, semi monthly or monthly.

The payroll application is the foundation of Paycom’s offering and all clients are required to utilize it in order to access other applications. As a result, most of the company’s revenue was generated through payroll applications, but this revenue mix is evolving as Paycom develops more non-payroll applications. The vision for Paycom is that companies should not have to perform payroll- and HCM-related tasks that systems can automate.

At the end of 2024, Paycom has approximately 37,500 clients, with an annual revenue retention rate of 90%.

Competitive Landscape

The market for HCM software is highly competitive and fragmented. Paycom’s target client size is small to mid-sized organizations with 50 to 10,000 or more employees. Based on 2023 data, Paycom is the second-largest payroll software vendor by market share, behind Automatic Data Processing (ADP). And Paycom has been taking market share over the years. Since its 2014 IPO, Paycom grew revenue around ~30% annually, significantly faster than the overall market (~5–10%).

Some of Paycom’s key competitors are Paylocity, Paycor and ADP. Paycom’s differentiation revolves around the simplicity of their technology and platform. Paycom’s functions are seamlessly integrated with each other using a single database and platform, rather than relying on integrating multiple databases or third-party platforms. This means that Paycom is able to roll out innovations quickly, provide real-time updates, and simplifies IT complexity for their clients. The downside of this approach though, is that it could be a more closed system. Some customers may prefer a more open ecosystem with the option to plug and play into third-party apps and features, depending on their needs. With Paycom, the customer would have to only use their built-in tools.

This means that Paycom would need to constantly roll out innovative products that add value to the customer to prevent churn. And they’ve done this well. The annual revenue retention rate has generally been over 90%. Further, they often introduce industry first features, such as BETI (Better Employee Transaction Interface), the self-service payroll system that launched in 2021. BETI changed the game by allowing employees to review and approve their own paychecks, improving efficiency by reducing HR’s workload and greatly reducing errors. BETI was so successful that it became a headwind to Paycom’s revenue as it additional fees clients previously paid for re-submitting tax form filings due to payroll errors. This move is a classic example of short-term pain for long-term gain, ensuring that the value to the customer is prioritized.

Key Financials

Opportunities

Upmarket expansion into larger enterprises

International expansion (Canada, UK, Ireland, Mexico)

Price increase: Charging a premium for features like BETI that saves clients money by reducing payroll errors, or further increasing the value of the platform to the client by adding more features

Risks

Competitive pressure: If competitors are able to copy Paycom’s best features, Paycom could struggle to maintain differentiation and lose deals to cheaper or more flexible competitors

Larger companies moving downmarket: Large HCM companies can bundle payroll with other services, locking them into the ecosystem and increasing switching costs

Conclusion

Paycom’s a company with strong historical growth, has a strong balance sheet with zero debt. While the company is still growing, it’s currently facing some growth headwinds due to the reduced payroll revenue from BETI. If Paycom continues to deliver value through both payroll and non-payroll features, it has room for further growth. While the industry remains highly competitive, its long-term success will ultimately depend on its ability to maintain a strong client focus and differentiate through innovation.

Disclaimer: Please note that none of the information provided constitutes financial, investment, or other professional advice. It is only intended for educational purposes. I have a vested interest in Paycom Software Inc. Holdings are subject to change at any time.