Company Snapshot: Intuitive Surgical (NASDAQ: ISRG)

Robotic Surgery Meets the Razor-and-Blade Model

Hi guys,

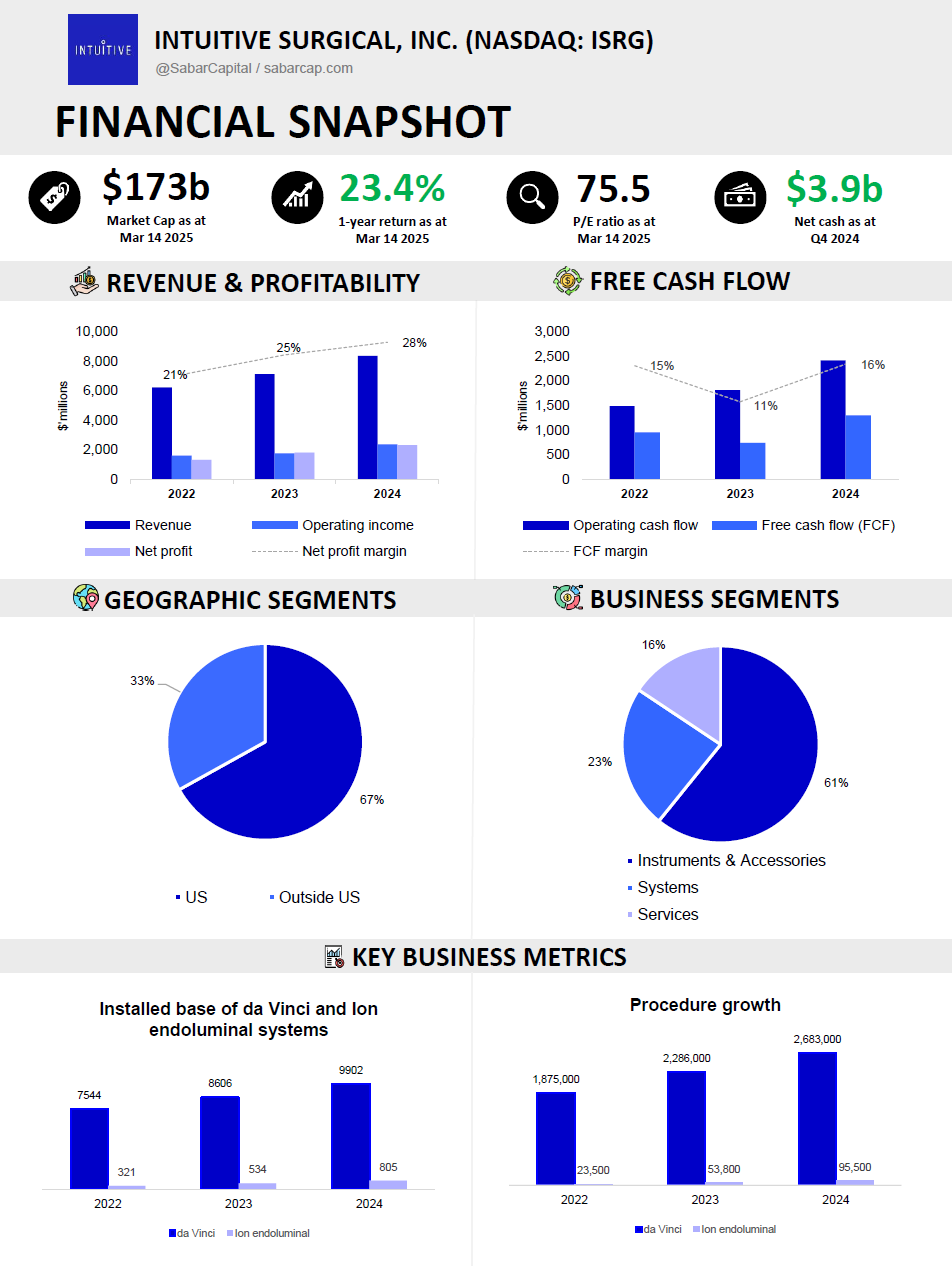

This week’s company is Intuitive Surgical (NASDAQ: ISRG), a ~$170b market cap company that produces robotic products for minimally invasive surgery.

The company follows a “razor and blades” model by selling a surgical system (razor) and the related instruments, accessories and services (blade). While ISRG does make a profit from its system sale, most of its revenue is recurring from the instruments and accessories that need to be replaced, and the services to maintain the system. Let’s dive in.

My idea of the Company Snapshot series is to offer a quick dive into a business, highlighting what makes them special. Rather than a lengthy deep dive, this format focuses on a high level overview, providing readers with digestible insights. Each Company Snapshot will follow this structure:

Business Overview

Competitive Landscape

Key Financials

Opportunities

Risks

Business Overview

Founded in 1995, Intuitive Surgical (ISRG) develops, manufactures and markets the da Vinci surgical system, which is a robotic platform that allows surgeons to perform complex, minimally invasive surgeries with greater precision and dexterity, using a surgeon's console to control robotic arms that move like a human hand with a larger range of motion.

While minimally invasive surgery (MIS) has helped to reduce trauma to patients by allowing surgeries to be performed through small ports rather than large incisions (e.g. a nose or boob job), the da Vinci surgical systems enable surgeons to extend the benefits of MIS by using computational, robotic, and imaging technologies to overcome many of the limitations of conventional MIS and traditional open surgery.

With the da Vinci system, surgeons can operate while being comfortably seated at a console, viewing high-definition imaging of the surgical field, therefore reducing surgeon fatigue. Further, the technology is designed to provide surgeons with a range of articulation of the surgical instruments used that is analogous to the motions of a human wrist, while filtering out the tremor inherent in a surgeon’s hand.

I’m not medically trained, so do bear with my oversimplification — but the da Vinci surgical system generally comprises of the following:

Surgeon Console: This is where the surgeon sits and controls the robotic arms using hand movements, which are translated into precise surgical action. In the newer models, there’s even an option for a second surgeon console to provide assistance;

Patient-Side Cart: Holds the robotic arms that move surgical instruments inside the patient;

3DHD Vision System: Provides a high-definition 3D view of the surgical area, able to digitally zoom and magnify the surgical field of view;

FireFly Fluorescence Imaging: Uses a special dye and camera to highlight blood flow and tissue in real time; and

Da Vinci Integrated Table Motion: Coordinates the movements of the da Vinci robotic arms with an advanced operating room table to enable managing the patient’s position in real-time while the robotic arms remain docked.

The Ion endoluminal system, which was cleared by the FDA in 2019, is a flexible, robot-assisted catheter-based platform that utilizes instruments and accessories for which the first cleared indication is minimally invasive biopsies in the lung. The system features an ultra-thin, ultra-maneuverable catheter than can articulate 180 degrees in all directions and allows navigation far into the peripheral lung and provides the stability necessary for precision in a biopsy.

The company also provides a suite of stapling, energy, and core instrumentation for its surgical systems; progressive learning pathways to support the use of its technology; a complement of services to its customers, including support, installation, repair, and maintenance; and integrated digital capabilities providing unified and connected offerings, streamlining performance for hospitals with program-enhancing insights.

ISRG follows the Quintuple Aim as its guiding principle:

Better Patient Outcomes – Products are designed to improve patient results, supported by rigorous, peer-reviewed evidence.

Enhanced Patient Experience – Innovations help patients recover faster with fewer complications, less pain, and greater predictability.

Support for Care Teams – Technology enhances clinician skills, reduces fatigue, and increases efficiency and reliability.

Lower Healthcare Costs – Solutions aim to reduce the total cost per patient episode compared to traditional treatments, delivering value for hospitals and payers.

Expanded Access to Care – Partnerships with hospitals, healthcare systems, and advocacy groups help overcome barriers to minimally invasive treatment.

ISRG generates up-front revenue from the placement of da Vinci surgical systems through sales or sales-type lease arrangements and recurring revenue over time through fixed-payment or usage-based operating lease arrangements. Said another way, ISRG sells the da Vinci system through sales, fixed repayment, or a “pay as you use” method. ISRG also earns recurring revenue from the sales of instruments, accessories, and services.

The selling price for the da Vinci surgical system and the Ion endoluminal system is between $0.7 million and $3.1 million and $500,000 and $815,000, respectively. Their instruments and accessories have limited lives and will either expire or wear out as they are used in surgery, at which point they need to be replaced.

For the da Vinci system, ISRG generally earns between $800 and $3,600 of instruments and accessories revenue per surgical procedure performed, depending on the type and complexity of the specific procedures performed and the number and type of instruments used.

Besides the sale of the system, ISRG also generates revenue from service contracts from the da Vinci system and the Ion endoluminal system, with an annual fee between $100,000 and $225,000 and $55,000 and $80,000 respectively. ISRG typically enters into a five-year service contract, with the first year provided for free.

ISRG’s recurring revenue, which consists of instruments and accessories revenue, service revenue, and operating lease revenue, makes up 84% of total revenue, in 2024. Instruments and accessories revenue has grown faster than systems revenue over time, reflecting the continued procedure adoption.

ISRG’s revenue is largely based in the US at approximately 67%, with the remaining 33% in international markets. As of end 2024, ISRG’s installed base of da Vinci surgical systems is approximately 9,902.

Competitive Landscape

When looking at ISRG’s competitive landscape, several key factors stand out:

Alternative Treatment Options: Robotic-assisted surgery isn’t the only option. Open surgery, conventional minimally invasive surgery (MIS), drug therapies, and radiation all compete with robotic procedures, depending on the type of condition being treated.

First-Mover Advantage & Market Leadership: Being the pioneer of robotic-assisted surgery and a strong reputation built over decades, reliability is a key advantage — especially in surgery, where precision and safety are critical. Additionally, extensive regulatory approvals worldwide create a high barrier to entry for competitors trying to catch up.

Installed Base & Ecosystem Lock-In: Hospitals that invest in da Vinci systems aren’t just buying a machine — they’re committing to an entire ecosystem. Each system costs millions of dollars and switching to another platform means additional costs for training, support, and upgrades. Since surgeons and staff need time to master the technology, hospitals have strong incentives to stick with ISRG rather than switch to a competitor.

Regulation: ISRG operates in a heavily regulated industry, with approvals required from the FDA in the U.S. and equivalent agencies worldwide.

Regulatory approvals are essential – Without clearance for its da Vinci and Ion systems, plus related instruments and accessories, ISRG can’t sell its products. The process is often long and unpredictable.

International complexity – Regulations vary by country, meaning ISRG must secure separate approvals for each market.

Pricing & market access hurdles – Some countries restrict how much hospitals can charge patients for robotic surgery or impose quotas on new surgical robots, making international expansion more challenging.

Key Financials

Opportunities

Worldwide procedure volumes continue to rise due to several drivers such as aging population, growing chronic disease cases and better healthcare access. Aligning with the Quintuple Aim, striving to improve patient outcomes, patient experience, care team experience, expanding access to MIS, and lowering the total cost per patient ensures ISRG to be well positioned in the long term

Other additional applications for the Ion endoluminal system, which the company plans to seek further regulatory approvals for it outside the US

Risks

Rising Competition from New Entrants: While ISRG has been the dominant force in robotic surgery for over 25 years, more companies are entering the space, developing their own robotic surgical systems. Further, the healthcare industry is experiencing consolidation, which could intensify competition and result in pricing pressures

System failures: IT system failures, cybersecurity issues would lead to significant harm and reputational damage of the business. Unlike a social media platform or e-commerce website, downtime could potentially be a life or death issue for patients

International operation risk: ISRG’s operations outside the US subject it to a variety of risks relating to failure to protect intellectual property, compliance with foreign laws, tariffs and trade barriers

Conclusion

ISRG is a strong and solid compounder that has proven the strength of its business model over decades. ISRG continues to benefit from the increasing global procedure volume as they grow their installed base of systems in and outside of the US. I’d imagine that the switching costs of ISRG’s ecosystem would make it difficult for competitors to penetrate, especially if hospitals have been using their system for years. So far, they’ve been doing very well, with 10-year revenue and earnings CAGR of about 14.6% and 17.9%, respectively. Such stellar financial metrics unfortunately come with a high price tag, trading at 77 P/E. Proven and great businesses rarely trade cheaply, especially with their solid track record and long term growth potential.

Disclaimer: Please note that none of the information provided constitutes financial, investment, or other professional advice. It is only intended for educational purposes.